Coconino County Property Appraiser

Assessor Coconino

Assessor's 2026 Real Property Notice of Value was mailed February 11, 2025. This statement advises property owners of their 2026 property value for tax purposes. A Copy of your Annual Notice of Value can be obtained by clicking the Annual Notice of Value image above.

https://www.coconino.az.gov/119/Assessor

Coconino County Assessor's Office issues annual Notice of Value Local News azdailysun.com

The Coconino County Assessor’s Office will begin mailing the 2027 Real Property Annual Notice of Value on Feb. 10. Property owners are asked to review this notice carefully, as it provides important information regarding property value for tax purposes. The annual Notice of Value (NOV) informs property owners of the assessor’s determination of their property’s full cash value, limited property value and classification.

https://azdailysun.com/news/local/coconino-county-assessors-office-issues-annual-notice-of-value/article_027ba183-2bc7-4b02-9892-5d8a296b614e.html

Assessor’s Office accepting applications for property tax exemption and relief programs • Coconino County, AZ

These programs help reduce or stabilize the property value used to calculate property taxes and are administered annually by the Assessor’s Office. Arizona law provides property tax assistance options for eligible widows and widowers, veterans with a disability and individuals with a permanent disability, commonly referred to as individual exemption programs.

https://www.coconino.az.gov/m/newsflash/Home/Detail/3346

Coconino County

Coconino - 🖋️The Coconino County Assessor's Office is now accepting applications for property ... Coconino County in 2026 and beyond. For more ...

https://www.facebook.com/CoconinoCounty/photos/%EF%B8%8Fthe-coconino-county-assessors-office-is-now-accepting-applications-for-property/1315379040621005/🏡The Coconino County Assessor’s Office will begin mailing the 2027 Real Property Annual Notice of Value on February 10. Property owners are encouraged to review this notice carefully, as it provides important information regarding their property value for tax purposes. In addition to reviewing their NOV, property owners are strongly encouraged to verify that their mailing address on file with the Assessor’s Office is current.

https://www.instagram.com/p/DTysYY1Dean/Coconino County Assessor Mailing Out Notice of Values ...

Coconino County Assessor Mailing Out Notice of Values February 10. January 21, 2026 /. 1/21 The Coconino County Assessor's Office will begin ...

https://myradioplace.com/coconino-county-assessor-mailing-out-notice-of-values-february-10/Assessor’s Office issues annual Notice of Value and launches new address change form • Coconino County, AZ

The Annual Notice of Value, commonly referred to as the NOV, informs property owners of the Assessor’s determination of their property’s full cash value, limited property value and classification. While the notice is not a tax bill, it is a critical opportunity for property owners to review the values that will be used by taxing jurisdictions to calculate their future tax bill.

https://www.coconino.az.gov/CivicAlerts.aspx?AID=3343

Coconino County adopts 2026 budget, holds Truth in Taxation ...

We use cookies to analyze site usage and improve your experience. You can change your preference any time.

https://citizenportal.ai/articles/6698627/Coconino-County/Arizona/Coconino-County-adopts-2026-budget-holds-Truth-in-Taxation-hearings-primary-rate-falls-while-property-valuations-lift-levies

🏡🖋️The Coconino County Assessor’s Office is now accepting applications for property tax exemption and relief programs. These annual programs are designed to assist qualified individuals with limited income by reducing or stabilizing the property value used to calculate property taxes. For eligibility details and application instructions, visit coconino.az.gov/assessor or contact the Assessor’s Office at 928-679-7962. For eligibility details an...

https://www.instagram.com/p/DUHL1c-DHfb/

Coconino County (@CoconinoCounty) / X

Due to the Rafael Fire, all areas south of 1-40, west of I-17, including University Heights, Kachina Village, Forest Highlands, Pine Dell, and Woody Mountain Road are now in SET status. Begin preparing for possible GO order to EVACUATE. THIS IS NOT AN EVAC NOTIFICATION.

https://x.com/CoconinoCounty

Search Coconino County Public Property Records Online CourthouseDirect.com

These cookies enable the website to provide enhanced functionality and personalisation. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

https://www.courthousedirect.com/PropertySearch/Arizona/Coconino

Real Estate Investing in Coconino County AZ [2026 Analysis] HouseCashin

Overview Coconino County Real Estate Investing Market Overview Over the past ten-year period, the population growth rate in Coconino County has an annual average of 0.71%. By contrast, the average rate at the same time was 1.24% for the entire state, and 0.69% nationwide.

https://housecashin.com/investing-guides/investing-coconino-county-az/![Real Estate Investing in Coconino County AZ [2026 Analysis] HouseCashin](screenshots/coconino_county_property_appraiser_16.jpg)

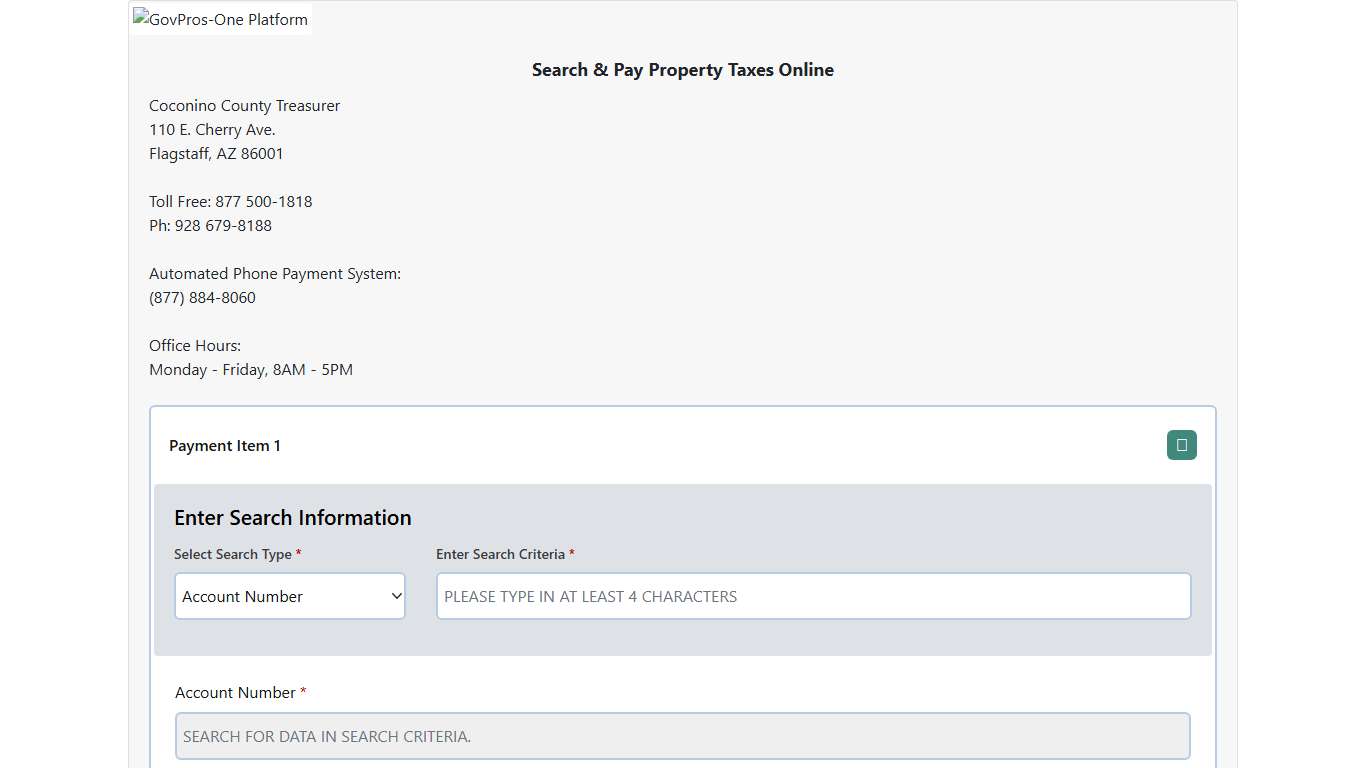

Property Taxes Online - Coconino County

**Dishonored e-checks are subject to additional penalties** GovPros charges a service fee to utilize its service to process the transaction above: The service fee is a separate charge from the payment amount and will reflect "GovPros Srvc Fee" on your banking statement.

https://pay.govpros.us/az/coconino/taxes

Coconino County, AZ Property Tax Calculator 2025-2026

Calculate Your Coconino County Property Taxes Coconino County Tax Information How are Property Taxes Calculated in Coconino County? Property taxes in Coconino County, Arizona are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.51% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/arizona/coconino-county